Don't be fooled – don't become a money mule

Money muling is on the rise in the UK, especially among young people such as students. We’ve teamed up with Financial Fraud Action UK (FFA UK) and Cifas, the UK’s leading fraud prevention service, to raise awareness of this type of serious fraud to help you stay informed and avoid getting involved.

How does money muling happen?

Fraudsters may ask you to receive money into your bank account and transfer it into another account, keeping some of the cash for yourself. If you let this happen, you’re a money mule. You’re involved in money laundering, which is a crime.

You can be approached by fraudsters online or in person. They might post what looks like a genuine job advert, then ask for your bank details.

Once you become a money mule, it can be hard to stop. You could be physically attacked or threatened with violence if you don’t continue to let your account be used by criminals.

When you’re caught:

- your bank account will be closed

- you will find it hard to access further student loans

- it will be difficult to get a mobile phone contract

- you will have problems applying for credit

- you could go to prison for up to 14 years.

Students can become money mules unwittingly. They might think they're giving out their bank details for a genuine reason, then end up involved in money mule fraud.

Don't Be Fooled. Follow this advice:

- Don’t give your bank account details to anyone unless you know and trust them.

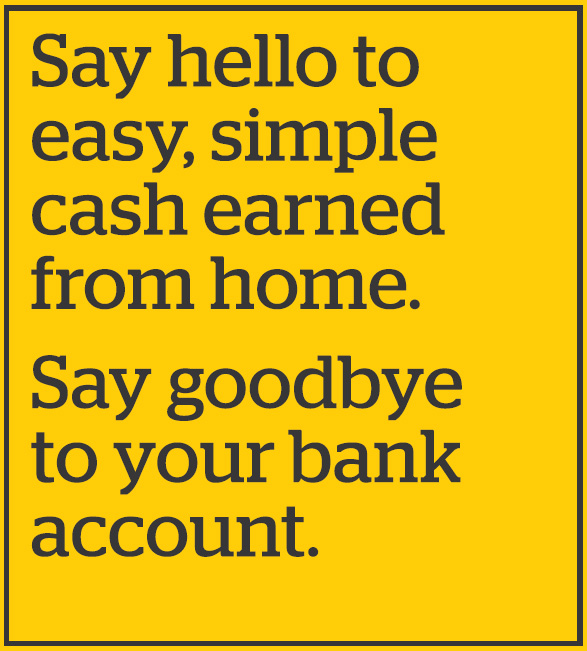

- Be cautious of unsolicited offers of easy money. If it sounds too good to be true, it probably is.

- Research any company that makes you a job offer and make sure their contact details are genuine.

- Be wary of job offers from overseas. It will be harder for you to find out if they are legitimate.

- Be wary of job ads that are written in poor English, with grammatical errors and spelling mistakes.

Check out this video below on how to stay safe and avoid becoming a money mule:

Katy Worobec, Head of Fraud and Financial Crime Prevention, Cyber and Data Sharing at UK Finance, said:

“Criminals are using young people as money mules in increasing numbers. We know that students are particularly vulnerable as they are often short of cash. That’s why we have launched the Don’t Be Fooled campaign.

“We want to raise awareness of the fact that money muling is money laundering. When you’re caught, your bank account will be closed, making it difficult to access cash and credit. You could even face up to 14 years in jail. We’re urging people not to give their bank account details to anyone unless they know and trust them. If an offer of easy money sounds too good to be true, it probably is.”

Simon Dukes, Chief Executive of Cifas, said:

“Our new figures show that money muling amongst young people is on the rise. This is a serious issue that not only has consequences for the money mule, but for society as a whole.

“The criminals behind money mules often use the cash to fund major crime, like terrorism and people trafficking. It’s this side of money muling that we want to raise awareness of with our new film. We want to educate young people about how serious this fraud is in the hope that they will think twice before getting involved.”