Your bank accounts: Don’t be fooled

Criminals are targeting students and young people with social media messages claiming to offer financial incentives if they transfer their bank accounts. The scam turns victims into "money mules", using their accounts for the illegal act of money laundering.

The Government’s new National Economic Crime Centre (NECC) recently froze 95 bank accounts of students at UK universities. These accounts are suspected of being used in significant money laundering operations. Many are held by overseas students who may be unaware that operating a bank account in this manner is potentially illegal.

Financial Fraud Action UK (FFA UK) and Cifas, the UK’s leading fraud prevention service, have created a ‘Don’t be a fool’ campaign to help you protect yourself. Keep reading for tips and advice.

If you think you have been a victim, please report this to your bank and the police immediately. You can also seek support from one of Queen Mary’s Welfare Advisers in Advice and Counselling.

How does money muling happen?

Fraudsters may ask you to receive money into your bank account and transfer it into another account, keeping some of the cash for yourself. If you let this happen, you’re a money mule. You’re involved in money laundering, which is a crime.

You can be approached by fraudsters online or in person. They might post what looks like a genuine job advert, then ask for your bank details.

Once you become a money mule, it can be hard to stop. You could be physically attacked or threatened with violence if you don’t continue to let your account be used by criminals.

When you’re caught:

- your bank account will be closed

- you will find it hard to access further student loans

- it will be difficult to get a mobile phone contract

- you will have problems applying for credit

- you could go to prison for up to 14 years.

Not realising that you are a money mule and that money laundering is a crime is never accepted as an excuse – you could still face prosecution by the police.

Don't be fooled. Follow this advice:

- Don’t give your bank account details to anyone unless you know and trust them.

- Be wary of job offers where all interactions and transactions will be done online.

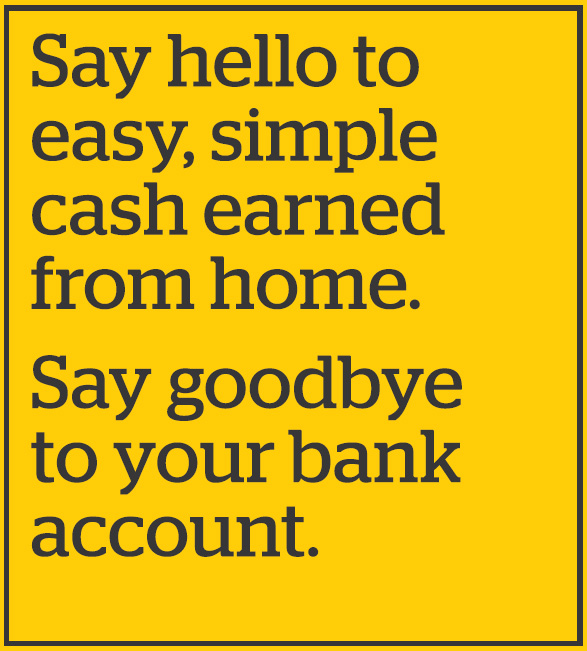

- Be cautious of unsolicited offers of easy money. If it sounds too good to be true, it probably is.

- Research any company that makes you a job offer and make sure their contact details are genuine.

- Be wary of job offers from overseas. It will be harder for you to find out if they are legitimate.

- Be wary of job ads that are written in poor English, with grammatical errors and spelling mistakes.

Check out this video below on how to stay safe and avoid becoming a money mule:

Universities UK (UUK, the collective voice of 136 universities in England, Scotland, Wales and Northern Ireland, has been asked by the Department for Education to act as a central point of contact for universities on this issue and to work with relevant agencies to produce further guidance. They have released the following statement:

“Universities UK has been informed of this action, which will help to raise awareness of the risks of money laundering. The security and welfare of students is always a top priority for universities. We would be concerned if any student studying at a UK university has been exploited and unwittingly drawn into criminal activity. Equally, we recognise the seriousness of this issue and the sector’s responsibility to make all students aware of the consequences of involvement in criminal activity.

“The message to students is to remain vigilant and question anything that seems unusual. We would encourage any student who fears their account may have been misused to speak to either their university support services, banks, or to the police.

“We will be working with the government and other stakeholders to develop a clear set of guidelines for the sector, to raise awareness and protect students from being targeted by organised crime groups.”

More information:

- Barclay’s has provided the following Fraud Advice for Students [PDF 426KB]

- The British Council’s Creating Confidence guidance, making sure that your time studying in the UK is safe and enjoyable

- The UK Council for International Student Affairs website on frauds and scams